In addition to having a low government take, the deep water Gulf of Mexico and other U.S. regions are attractive targets for investment because they have large remaining oil and gas reserves and the U.S. is generally a good place to do business compared to many other countries with comparable oil and gas resources. Multiple studies completed as early as 1994 and as recently as June 2007 indicate that the U.S. government take in the Gulf of Mexico is lower than that of most other fiscal systems. For example, data GAO evaluated from a June 2007 industry consulting firm report indicated that the government take in the deep water U.S. Gulf of Mexico ranked 93rd lowest of 104 oil and gas fiscal systems evaluated. Generally, other measures indicate that the United States is an attractive target for oil and gas investment. The lack of price flexibility in royalty rates -- automatic adjustment of these rates to changes in oil and gas prices or other market conditions -- and the inability to change fiscal terms on existing leases have put pressure on Interior and the Congress to change royalty rates in the past on an ad hoc basis with consequences that could amount to billions of dollars of foregone revenue. For example, royalty relief granted on leases issued in the deep water areas of the Gulf of Mexico between 1996 and 2000 -- a period when oil and gas prices and industry profits were much lower than they are today -- could cost the federal government between $21 billion and $53 billion, depending on the outcome of ongoing litigation challenging the authority of Interior to place price thresholds that would remove the royalty relief offered on certain leases. Further, royalty rate increases in 2007 are expected to generate modest increases in federal revenues from future leases offered in the Gulf of Mexico. However, in choosing to increase royalty rates, Interior did not evaluate the entire oil and gas fiscal system to determine whether or not these increases strike the proper balance between the attractiveness of federal leases for investment and appropriate returns to the federal government for oil and gas resources. Interior does not routinely evaluate the federal oil and gas fiscal system, monitor what other governments or resource owners are receiving for their energy resources, or evaluate and compare the attractiveness of federal lands and waters for oil and gas investment with that of other oil and gas regions. As a result, Interior cannot assess whether or not there is a proper balance between the attractiveness of federal leases for investment and appropriate returns to the federal government for oil and gas resources. Specifically, Interior does not have procedures in place for evaluating the ranking of (1) the federal oil and gas fiscal system or (2) industry rates of return on federal leases against other resource owners. Interior also does not have the authority to alter tax components of the oil and gas fiscal system. All these factors are essential to inform decisions about whether or how to alter the federal oil and gas fiscal system in response to changing market conditions.

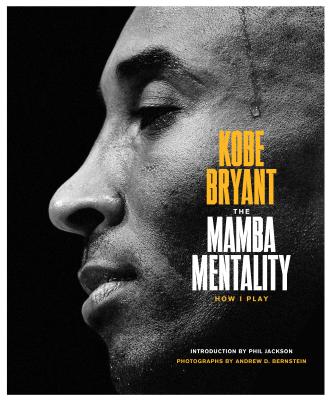

Get Royalties at Risk in the Development of the Nation's Natural Resources by at the best price and quality guranteed only at Werezi Africa largest book ecommerce store. The book was published by Nova Science Publishers Inc and it has pages. Enjoy Shopping Best Offers & Deals on books Online from Werezi - Receive at your doorstep - Fast Delivery - Secure mode of Payment

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss

Jacket, Women

Jacket, Women

Woolend Jacket

Woolend Jacket

Western denim

Western denim

Mini Dresss

Mini Dresss